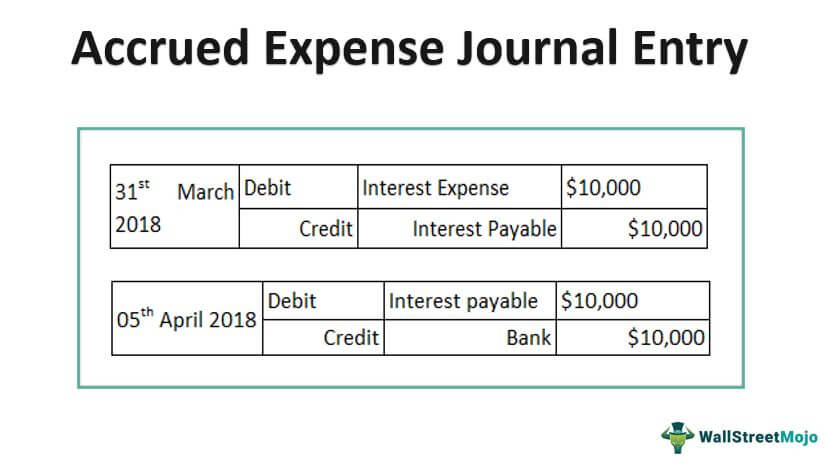

In place of the documentation, a journal entry is created to record an accrued expense, as well as an offsetting liability. On the other side, we are also going to take it out of cash by crediting cash (so cash goes down). Accrued Expenses - Schedule of Accrued Expenses (Detail) Accrued bonus compensation Accrued payroll and benefits Accrued research costs 422,226 99,548. An accrued expense is an expense that has been incurred, but for which there is not yet any expenditure documentation. When we actually do pay it, we'll take it out of salaries payable by debiting accounts payable. So, we are going to credit an account called - salaries payable. I've got to figure out a way to say I still owe them that money. I have to have something on the other side of the accounting equation to make it balance. 31st, I'm going to put as a debit (because we're dealing with expenses here) on salaries expense. So let's look at how we would how we would do this. It’s usually for subscription based costs, interest payments, or services that haven’t been invoiced yet. We've got to put them into an expense account, but we're going to hold back off on the cash right now. Accrued expenses are expenses a company accounts for when they happen, as opposed to when they are actually invoiced or paid for. Accrued expenses is an accounting term used to describe a cost that you will need to pay in the future, but haven’t been officially charged for yet. So, we have to record this at that end of Year 1.

Now, these funds are earned by the employee and owed by Bravo company in Year 1, but are going to be paid in Year 2. Example of an Accrued Expenseīravo Company accrued six thousand dollars of salary/bonus expense that will be paid at the beginning of the year. We're waiting until December 31st to do this. So accrued expenses are the costs that are incurred in a period that are both unpaid and have not been recorded.

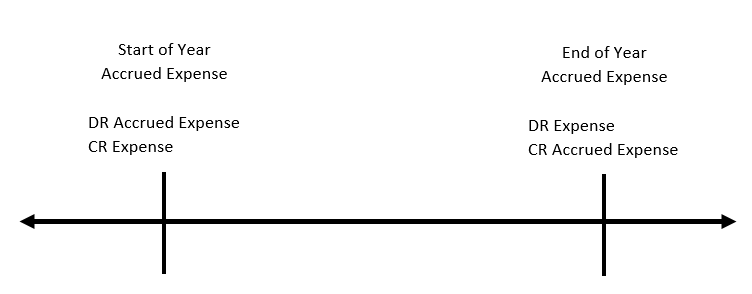

But unlike accounts payable, there is no invoice - an accrued. At that point, you will record it as an expense that can be maintained as a liability or paid. Accrued expenses, sometimes called accrued liabilities, are costs incurred by the business. So, you are incurring an expense throughout the year and you are recording it at the end of your accounting period (generally December 31st). With an Accrued Expense, cash has not been affected yet - as the debt will be paid or recorded at a later date.

#ACCRUED EXPENSE HOW TO#

Update Table of Contents What is an Accrued Expense? How to Record Accrued Expenses? Example of an Accrued Expense What is an Accrued Expense?Īccrued expenses are things that we have been using, but we have not paid for them yet.īack to: Accounting & Taxation How to Record Accrued Expenses?

0 kommentar(er)

0 kommentar(er)